Southeast Michigan 2024 Housing: Trends and Predictions

Through the first half of 2024, expect demand to continue to outweigh supply. However, as the year progresses, expect to see inventory gradually rise into a more balanced position as homeowners who have been thinking about selling for the past two years come down off the fence.

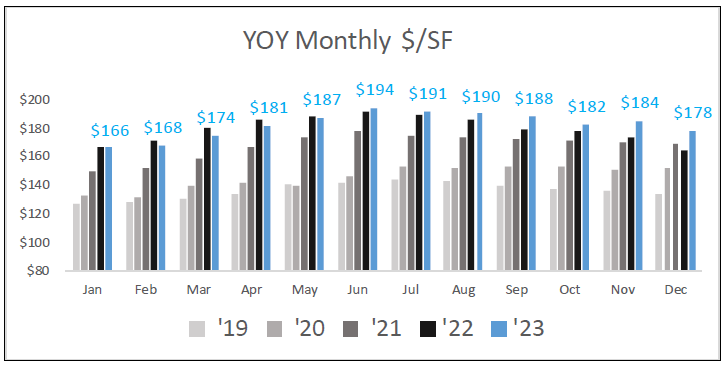

The lack of inventory had a negative impact on 2023 sales and depleted inventory levels held sales volume down. Through the first half of 2023, prices were down from the prior year. That flipped in June and since then monthly average prices have been up. Overall, while ‘23 values finished just 1% higher than the prior year, YOY values for November and December were up 7% and 8%. Expect this momentum to extend into the early months of 2024. The projected periodic decreases in interest rates through the year should attract additional sellers and buyers. Rates are expected to drop below 6% in the second half of the year.

Showing Activity Up

Weekly showings are an early indicator of buyer demand. Although available listings are down 30% compared to the same time in 2019, recent showings are up 28% compared to that pre-pandemic market. Despite last year’s depleted inventory levels, robust buyer demand over the last eight months has kept showing activity running even with high performance years that didn’t have inventory shortages.

Activity growth the upper-end market is even more impressive. Showings for properties over $750,000 have more than doubled since before the pandemic and activity will continue to increase every month.

Inventory Shortages Expected to Ease

Local housing markets have been in a tight spot, with available listings down 30% compared to pre-pandemic times. The shortage affects both buyers and sellers. Potential sellers have been hesitant to list their homes as they worry there won’t be suitable homes for them to buy. Homeowners are also reluctant to give up their existing low mortgage rates and capped taxes. But as life moves on and needs change expect to see more would-be sellers move off of the fence.

Expected interest rate adjustments throughout the year should have rates around or below 6% by the end of the year. Over time, consumer acceptance that rates that start with a 6 or 7 are the new (and historic) normal will help to engage more buyers and sellers who will bring additional inventory to help balance the market.

It will take time for the listing shortages to ease and may take a year or more for the market to be in balance. Through the first half of 2024, expect buyers to compete with multiple offers for the best listings. Homes with deferred maintenance and that need updating will take longer to sell and will sell for less.

Rising Prices Will Continue

The 2023 average sale price and price per square foot rose by just 1% compared to the prior year. Year-over-year (YOY) monthly prices got off to a slow start and lagged behind through the first half. Since June, YOY prices were up each month. In the fourth quarter prices were up 7%. Expect to see that momentum carry over into 2024.

Half of December closed sales were at or above asking price. That’s up from 40% in 2022. Typical non-pandemic numbers were around 25 or 30%. The high frequency of “At or Over Asking” sales provides another indication that the market is carrying positive momentum into 2024.

Michigan Property Taxes in a Nutshell

2 minutes

Deprecated: preg_split(): Passing null to parameter #2 ($subject) of type string is deprecated in /usr/share/wordpress/blog/reo_blog/wp-includes/formatting.php on line 3506

After several years of rapidly rising prices and mild inflation (until the past two years) homebuyers and sellers need to be aware of the potential for a significant jump between [...]

Southeast Michigan 2024 Housing: Trends and Predictions

2 minutes

Deprecated: preg_split(): Passing null to parameter #2 ($subject) of type string is deprecated in /usr/share/wordpress/blog/reo_blog/wp-includes/formatting.php on line 3506

Through the first half of 2024, expect demand to continue to outweigh supply. However, as the year progresses, expect to see inventory gradually rise into a more balanced position as [...]

’23 Market Summary and ’24 Predictions

< 1 minute

Deprecated: preg_split(): Passing null to parameter #2 ($subject) of type string is deprecated in /usr/share/wordpress/blog/reo_blog/wp-includes/formatting.php on line 3506

After a few years of supply shortages, inventory began to return to more normal levels in the second half of 2023. Demand remains strong and buyers continue to wait for [...]